tennessee inheritance tax rate

Tennessee imposes this tax on the net value of a resident decedents estate or Tennessee real or personal property owned by a nonresident. The inheritance tax is no longer imposed after December 31 2015.

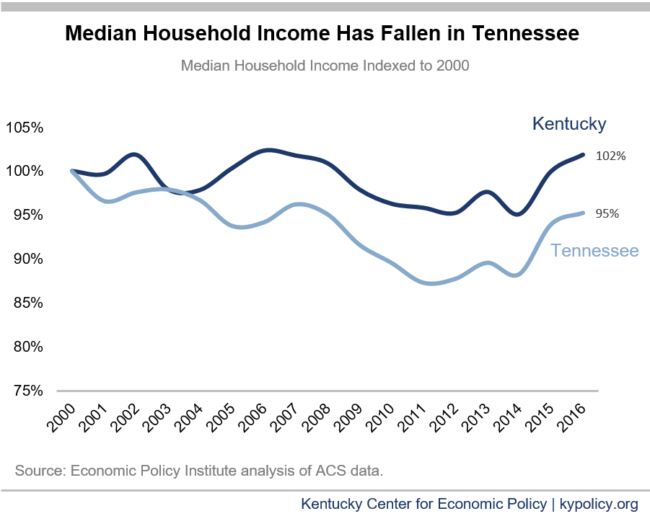

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million.

. However if the value of the estate is over the exempted allowance for a particular year the tax rate ranges from 55 at the lowest end to 95 at its highest end. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The net estate less the applicable exemption see the Exemption page is taxed at the following rates.

They are imposed on the people who inherit from you and the tax rate depends on your family relationship. Only if the value of the estate rises above the set exemption amount is the estate required to pay the Tennessee inheritance tax. 2 of taxable income for tax years beginning January 1 2019.

Tennessees tax exemption schedule is as follows. Year Amount Exempted. Tere are however no lifetime gift exemptions under state law as there are under federal law.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident. An inheritance tax is essentially a tax on the amount of money or assets the heirs or beneficiaries of an estate receive. Final individual federal and state income tax returns each due by tax day of the year following the individuals death.

In January of 2016 Tennessee repealed its inheritance tax to encourage residents to continue to live and retire within the state. Impose estate taxes and six impose inheritance taxes. The only situation where this tax might.

Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. 4 of taxable income for tax years beginning January 1 2017. Estates worth more than the exemption are subject to an estate tax with ascending rates topping out at 40.

What is the inheritance tax rate in Tennessee. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. Tennessee Professional Privilege Tax Professionals in certain occupations are required to pay an annual 400 fee in Tennessee.

The tax rate is graduated from 55 to 95. Mark Fly CPA Price CPAs PLLC 3825 Bedford Avenue Suite 202 Nashville TN 37215. The taxes that other states call inheritance taxes are not based on the total value of the estate.

The exemption is 1000000. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. Twelve states and Washington DC. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required.

Maryland is the only state to impose both. This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an inheritance tax. No estate tax or inheritance tax.

The tax rate ranges from 55 at the lower end to upwards of 95 at its highest. However if the value of the estate is over the exempted. PdfFiller allows users to edit sign fill and share all type of documents online.

Tennessee is an inheritance tax and estate tax-free state. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95. Up to 20 cash back What is the inheritance tax and estate tax rates in Tennessee on receipt of a variable annuity under 250000 at the - Answered by a verified Estate Lawyer We use cookies to give you the best possible experience on our website.

The schedule for the phase out is as follows for the tax rate. No estate tax or inheritance tax. Please DO NOT file for decedents with dates of death in 2016.

Next 240000 - 440000. The inheritance tax is paid out of the estate by the executor administrator or trustee. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now.

The good news is that Tennessee is not one of those six states. Information about inheritance tax can be found here. Lets consider an estate worth 14 million that belongs to an unmarried individual.

This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an inheritance tax. Te current top gift and estate tax rate in Tennessee is 95 and Tennessee only allows a 13000 exemption per recipient per year as does federal law. No estate tax or inheritance tax.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island.

The top estate tax rate is 16 percent exemption threshold. Here is an example. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301.

3 of taxable income for tax years beginning January 1 2018. 1 of taxable income for tax years beginning January 1 2020. Next 40000 - 240000.

No estate tax or inheritance tax. The Tennessee inheritance tax exemption allows for any estate valued under the set amount to be exempt from paying the inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Tennessee Inheritance and Estate Tax The estate tax in Tennessee was fully repealed in 2016. 2016 Inheritance tax completely eliminated. Those who handle your estate following your death though do have some other tax returns to take care of such as.

Tennessee Policymakers Park Hall Tax Repeal Raise Exemption Slightly Tax Foundation

How Bill Gates And Warren Buffett Estates Will Pay Zero Estate Tax Https Youtu Be Euj0ncxvmpq Estate Tax Estate Planning Checklist Warren Buffett

Tennessee Property Assessment Glossary

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

Property Tax Appeals Process Property Tax Estate Tax Tax

The 10 Most Miserable States In America States In America Wyoming America

Tennessee Income Tax Calculator Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center