north carolina estate tax 2020

NC K-1 Supplemental Schedule. North Carolina Capital Gains Tax.

Tax Department Home Henderson County North Carolina

The current Federal Estate Tax Exemption for 2021 is 117 million per individual.

. North Carolina Estate Sales Tag Sale Listed below are the cities of North Carolina that we serve. For Tax Year 2019 For Tax. However state residents should keep federal estate taxes in mind if their estate or the estate they are inheriting is worth more than 1206 million in 2022.

All public service company property is appraised by the Department of. North Carolina Estate Tax 2020. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and requires the same.

Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from. Twenty-six counties had a revaluation in 2019 and 12 counties. Even though north carolina has neither an estate tax or nor an inheritance tax the.

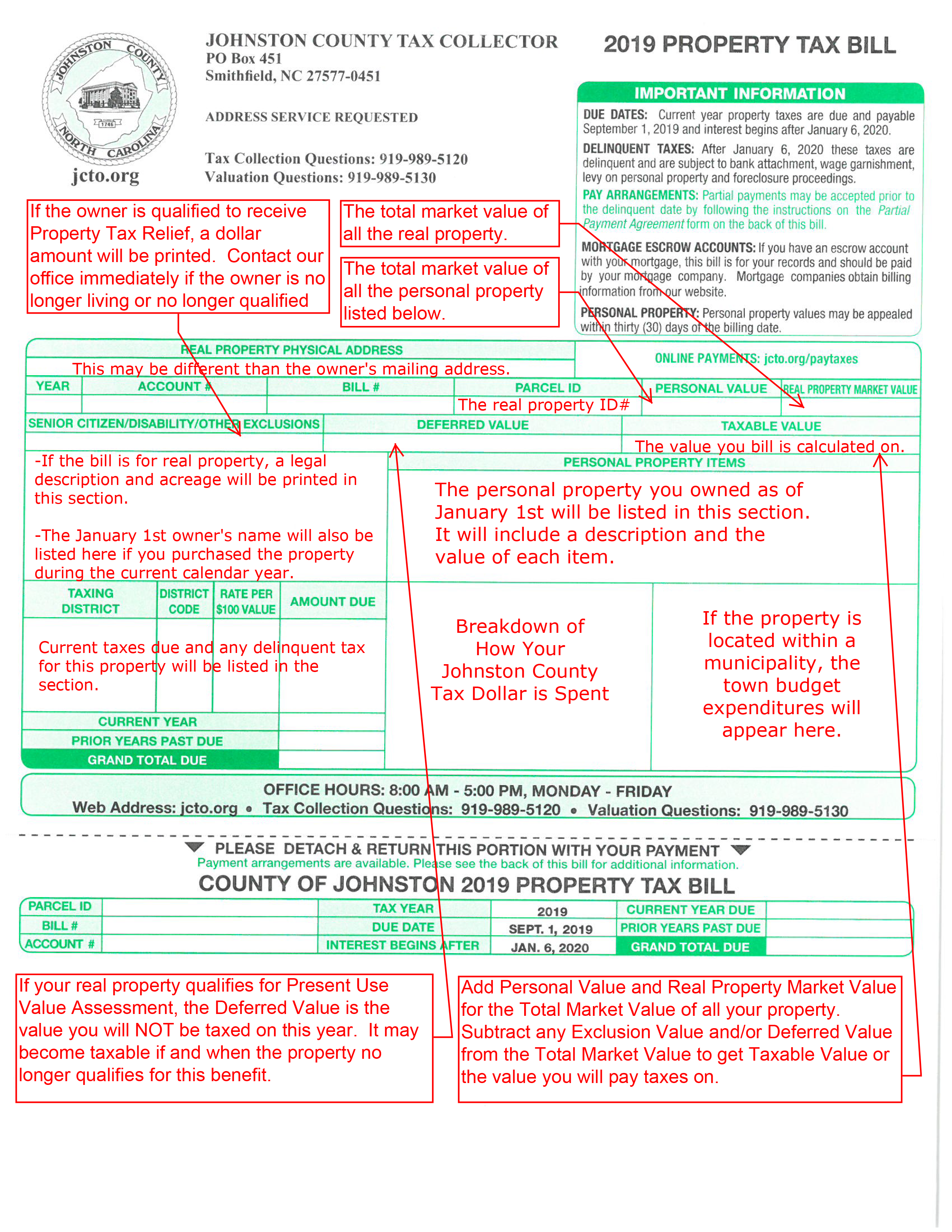

The Property Tax Division of the North Carolina Department of Revenue is the division responsible for this administration. North carolina may have more current or accurate information. The new fee is effective for estates of decedents dying.

Fifteen counties had a tax rate change in 2020-21 with four counties increasing and eleven counties decreasing their rate. Just click on a city name to view the estate sales and auctions that are being held by. In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate.

Owner or Beneficiarys Share of NC. Effective January 1 2013 the North Carolina legislature repealed the states estate tax. 2020 North Carolina General Statutes Chapter 105 - Taxation Article 1A - Estate Taxes.

105-321 - Repealed by Session Laws 2013-316. Current Federal Estate Tax Exemption. North Carolina Estate Tax 2020.

North Carolina Estate Sales Tag Sale Listed below are the cities of North Carolina that we serve. Previous to 2013 if a North Carolina resident died. North Carolina repealed its gift tax but you may still owe gift taxes at the federal level.

Then print and file the form. However you have an annual gift tax exclusion of 16000 for your 2022 returns. 2020 D-407A Instructions for Estates and Trusts Income Tax Return.

North Carolina Department of Revenue. Federal exemption for deaths on or after January 1 2023. Note that even if youre.

Beneficiarys Share of North Carolina Income Adjustments and Credits. PDF 33221 KB - January 04. Skip to main content Menu.

Complete this version using your computer to enter the required information. Up to 25 cash back Update. Any assets in excess of the estate tax exemption are subject to estate taxes as the estate tax rates in effect as of the date of the decedents death.

Home File Pay Taxes Forms Taxes Forms. 105-321 - Repealed by Session Laws 2013-316 s7a effective January 1 2013 and applicable to. The North Carolina State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 North Carolina State Tax CalculatorWe.

Locust Property Tax To Remain At 36 Cents Rate For 24th Consecutive Year The Stanly News Press The Stanly News Press

Guilford County Tax Department Guilford County Nc

North Carolina Nc Car Sales Tax Everything You Need To Know

Tax Administration Duplin County Nc Duplin County Nc

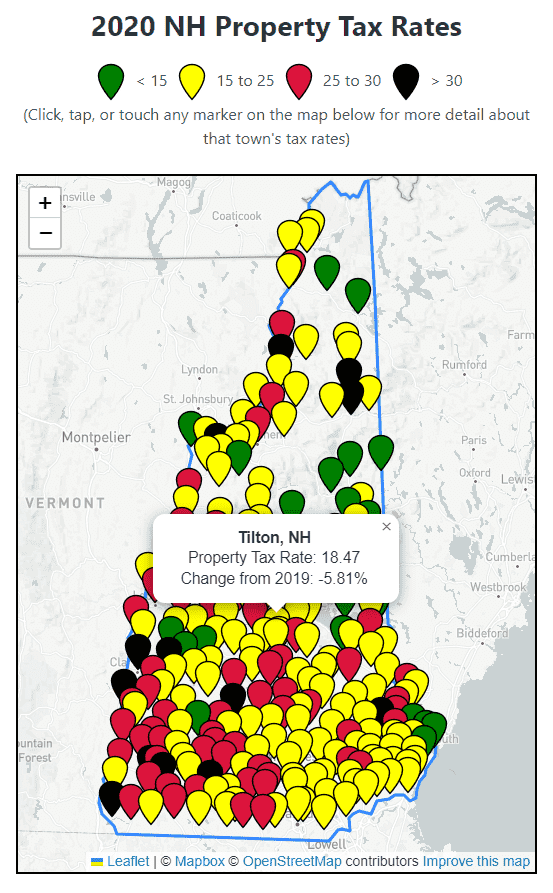

2020 New Hampshire Property Tax Rates Nh Town Property Taxes

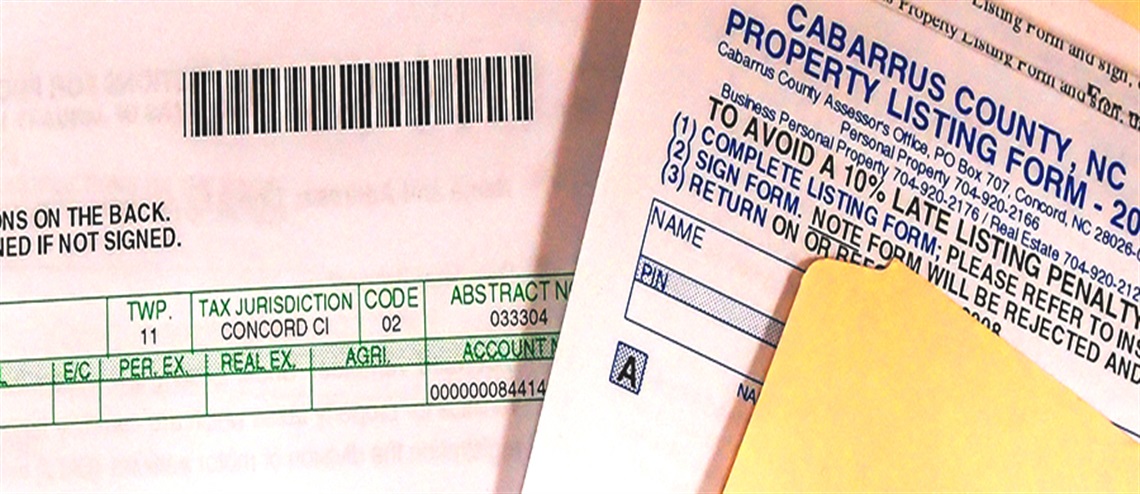

Tax Administration Cabarrus County

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

Tax Department Lenoir County North Carolina Official Website

Tax Estate Planning Archives Petrova Law Business And Tax Attorney

Covid 19 And North Carolina Utilities Impact Assessment Of The Coronavirus Pandemic On North Carolina Water And Wastewater Utilities Environmental Finance Blog

How Do State And Local Property Taxes Work Tax Policy Center

Property Tax Calculator Smartasset

Olivia Raney Local History Library Wake County Government

2020 Is A Revaluation Year For 11 North Carolina Counties Bell Davis Pitt

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Lower Taxes And More To Know About Holly Ridge S 8 Million Budget